Relief for Restaurants: House Passes Tax Bill, Senate Action Needed!

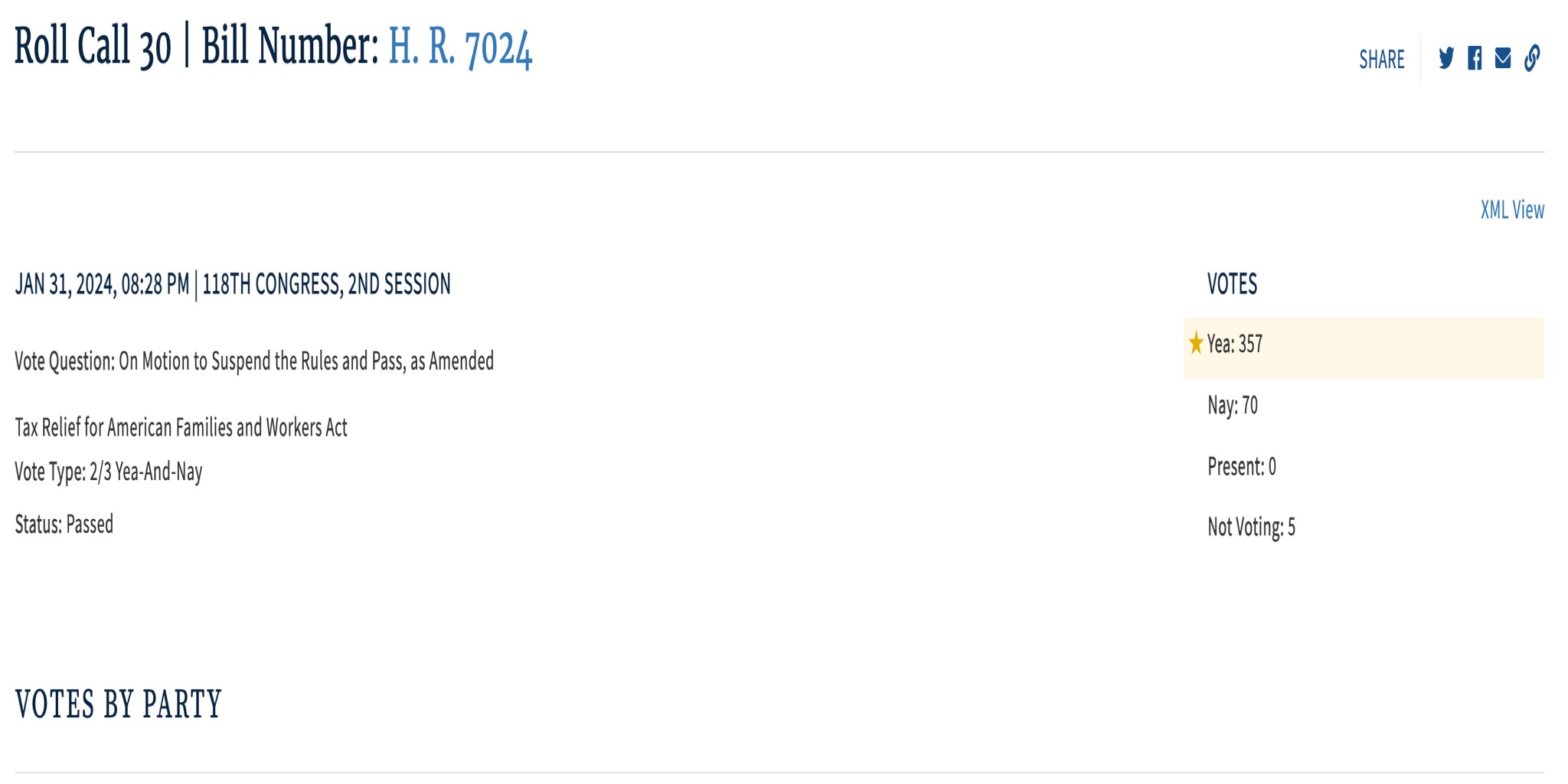

Good news for restaurant owners! The House of Representatives just passed H.R. 7024, a bill that includes significant tax breaks specifically designed to help your business thrive.

This bill partially restores business interest expensing, making it easier for you to invest in improvements like kitchen upgrades, dining room remodels, expansions, and renovations. These investments not only enhance your customer experience but also boost your bottom line.

But that's not all! H.R. 7024 also accelerates bonus depreciation, allowing you to immediately deduct the entire cost of certain equipment and technology purchases. This frees up valuable cash flow to invest back into your business, hire new staff, or adapt to changing market trends.

However, the Senate still needs to pass this bill before it becomes law. Now is the time to make your voice heard! Contact your Senators today and urge them to support H.R. 7024. This bill is a lifeline for restaurants struggling to recover from the pandemic and navigate an uncertain economic climate. Together, we can ensure it passes the Senate and becomes a reality for businesses like yours.

Find your Senators and take action here!