Who would have thought accepting money could be such a business pain point? But it certainly can be. In fact, the more successful your business is, the more of a hassle payments can be with higher processing volumes.

And the greater the unnecessary costs.

In fact, if you’re booking more than $50,000 per month in credit card business, you are undoubtedly overpaying on credit card fees. You just don’t know it yet!

While many small businesses have been able to use automated tools like QuickBooks Payments to help with this fundamental task of doing business, there comes a point in the business life cycle when these tools simply aren’t doing the job anymore. Or, at least, not doing the job as efficiently and cost-effectively as possible.

Other businesses may be slogging along with clunky forms of payment—from accepting checks to processing credit card payments manually. These efforts can add costs and slow the time it takes for you to put your revenue to work for you!

Fortunately, other alternatives can do the job significantly better.

QuickBooks Payments' Limitations for Growing Businesses

QuickBooks is a powerful tool for many businesses. Let’s just get that out there right away. That’s why they’re so successful; we partner with QuickBooks ourselves. However, as businesses grow, many outgrow the capabilities of QuickBooks. Here are three key reasons why:

-

Limited Payment Options

QuickBooks covers B2B business basics but has limited payment options using a “one-size-fits-all” approach. If you want an enhanced B2B payments solution, QuickBooks cannot provide it. -

Higher Processing Costs

Businesses often find that as their number of transactions grows, so do their incremental processing costs. Whether you’re processing a high volume or lower dollar payments—or a lower volume of higher dollar payments—when you get to a certain monthly income level, your options will be limited through a tool like QuickBooks. And you’ll pay for those options. -

Limited Customization

QuickBooks also fails to offer the kind of customization options that businesses generally need as they learn about the unique needs of their customers—and their business. Their “one-size-fits-all” solution really doesn’t fit all!

The more you grow, the more variation you’ll discover you need to address to continue providing the level of service that will set you apart from your competitors. The ability to customize credit card processing to meet your—and your customers’ needs—is critical.

QuickBooks recognizes these limitations and approves third-party customization options that integrate to meet these needs. But these only go so far. Eventually, it makes the most sense for some companies to consider other options.

Unfortunately, in many cases, businesses aren’t even aware that they’re not getting the biggest bang for their buck! If everything’s working “just fine,” why mess with success?

Taking Action on Payments - Addressing the “If It Ain’t Broke, Don’t Fix It” Mentality

The Rise in Credit Card Transactions

We get it. Business owners have a lot on their plates. When some aspects of their business seem to be working just fine until they lift the hood to take a more critical look, they will likely keep doing business the way they’ve always have.

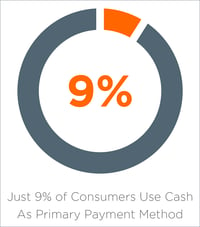

Yet consumer habits continue to change. For instance, a Forbes Advisor survey from February 2023 indicates that “just 9% of Americans primarily use cash to pay for purchases.” Credit card use, though, continues to rise: 36% use a physical or virtual card to pay for services. Often, small to medium size business owners operate like consumers which is why we see B2B processing on the rise. Another Forbes Money Newsletter reports that “organizations found that digital B2B payments are considered better, faster, and cheaper than existing processes.”

Yet consumer habits continue to change. For instance, a Forbes Advisor survey from February 2023 indicates that “just 9% of Americans primarily use cash to pay for purchases.” Credit card use, though, continues to rise: 36% use a physical or virtual card to pay for services. Often, small to medium size business owners operate like consumers which is why we see B2B processing on the rise. Another Forbes Money Newsletter reports that “organizations found that digital B2B payments are considered better, faster, and cheaper than existing processes.”

Not only does failing to stay on top of payment trends result in unnecessary costs—but also, less than optimum service for customers and clients. And lost opportunities.

For instance, Visa and Mastercard offer lower pricing (or discounts) to processors that can meet specific criteria. Processors like Spark Solutions can automatically implement those criteria for clients so that when businesses pay via credit card, those discounts are automatically applied—in some cases, up to 1% per transaction.

That may not seem like a lot on the surface, but consider a client processing $30,000 transactions regularly—or 3,000, $300 transactions. In either case, that potential savings can add up very quickly.

Streamlining Accounts Receivable

Another area where more sophisticated payment processing firms can add value is on the back end. Most credit card processing vendors understand the payment end of things—they can accept payments and process their fees for accepting those payments.

What they don’t worry about, though—that we do worry about—is the back end. They don’t work directly with their clients to help them efficiently and cost-effectively implement these processes within their businesses. We do. We’ll help you streamline your accounts receivable function to avoid the need to jump in and out of several systems.

|

CASE IN POINT: When we took over their account, we were able to help them manage the entire process and the conversion to ensure that all properties were communicating together correctly and that the interfaces would work as intended. We saved them money by ensuring more of their payments flowed to them and that there would be no processing interruptions. We helped them build the right project plan to provide a seamless transition for them and their customers while maximizing revenue. The devil, as they say, is in the details—and the discounts, in this case. |

Labor Costs

The highest cost of doing business, according to Paycor, is staffing. Labor costs, they say, “can account for as much as 70% of total business.” Gaining efficiencies with payment processing can help drive these costs down. This represents a "hidden" cost that can be addressed by implementing a better credit card processing solution.

The highest cost of doing business, according to Paycor, is staffing. Labor costs, they say, “can account for as much as 70% of total business.” Gaining efficiencies with payment processing can help drive these costs down. This represents a "hidden" cost that can be addressed by implementing a better credit card processing solution.

As indicated, in many cases, businesses aren’t even aware that they should be exploring different options than they currently use. Often, the point at which they recognize the need is when a vendor approaches them with an offer. And those offers can sound pretty appealing. But it's important to know what to look for—and what to look out for when shopping for alternative payment processing solutions.

Shopping for a Credit Card Processing Solution

There are several credit card processing solutions out there. As we’ve seen, though, not all offer the same functionality, customization options, or cost-effective price points. Here are some considerations to keep in mind as you explore the best credit card processing solution for your business.

Assessing Your Business’s Unique Needs and Goals

Your business is not like any other business. Your products and services will vary. Your target audience will vary. Your customers and their needs will vary. So will your preferences in terms of cost, service, and functionality.

The first step in considering which options will be best for you is assessing your business’s unique needs and goals. What functionality do you need from an operational standpoint? What budget considerations are important to you? What is your current and anticipated transaction volume?

Key Features to Look For in a B2B Credit Card Processor

When looking for a B2B credit card processor, some key features you should be looking for include discounted pricing for B2B companies, ACH processing, discounts for transactions over $100K/month, flexibility and customization, and personalized service. This isn’t a situation where you’re looking for a plug-and-play solution. You want to choose a vendor that will provide you with individualized support that starts at the front end with advice specific to your needs.

Comparing B2B Credit Card Processing Solutions

As you compare various B2B credit card processing solutions, there are several things to think about, including:

- General software features.

- Data security and fraud reduction features.

- Customer support.

- Business, corporate, and purchasing card processing.

- Mobile applications.

- Receipts and reports.

- Customer profile storage.

- Pre-integrated payment link.

- Pre-integrated donation link.

- Application Programming Interface (API).

- E-check/ACH processing.

- Recurring payments.

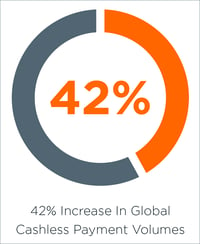

Ease of payment is increasingly important to consumers. PwC data has shown a 42% increase in global cashless payment volumes, with 89% of respondents pointing to e-commerce as a big driver behind this growth.

Yes, there’s a lot to think about. But we can help you step through these features and why they are—or may not be—important to you.

Comparing B2B Credit Card Processing Solutions

When comparing credit card processors, some of your top considerations will include:

Pricing Structure and Fees

Pricing structure and fees will be top-of-mind when considering a credit card processing solution, but rates often need clarification. We’re committed to transparency and advocate for honest and open communication with business owners to ensure they fully understand how and what they will be charged for transactions.

Level II & III Processing Support

Businesses can benefit from lower processing costs by submitting credit card transactions with Level II and Level III card data, which qualify for lower interchange rates. It's considered best practice for businesses and merchants to submit Level 2 and Level 3 card data whenever possible to optimize their processing costs.

Spark uses PayTrace, which takes advantage of Level II & III data pricing options. When you gather the right information—e.g., employer ID, sales tax, SIC code—processing rates can be reduced, saving you money.

Integration With Accounting Software

Processing payments isn’t just about receiving them. Once payment is received, it can impact other back-end processes that need to be integrated to save time in manual processing. Understanding how your B2B credit card solution interfaces and integrates with your accounting software is essential. Flexible integrations connect your business accounting, CRM, ERP, and ecommerce systems.

Hardware Requirements/Needs for Payments

Depending on how you interact with customers and how payments are received, you may have certain hardware requirements—like the need for point-of-purchase terminals or kiosks.

Security and Compliance Features

Security is a critical concern for business (and their customers). You want to ensure that your credit card processing vendor can provide the security protections you need to thwart cyber attacks and maintain compliance with data security regulations and requirements. For instance, PCI compliance ensures that customer data is safeguarded.

Customer Support and Resources

Finally, customer support is going to be an important consideration. You need a partner that is going to bring value to the process. That will take the time to understand your needs and work with you to not only find the best solution but also help you implement it appropriately and efficiently—and be available for any support questions or consultation as your business grows and its needs change. You want real people by your side.

The Role of Transparency and Honesty

Transparency and honesty are critical in the credit card processing industry. Unfortunately, businesses must be aware of several common deceptive practices when selecting a credit card processing partner. The FTC says that:

“Protecting small businesses from deceptive and unfair practices is a key priority (for the FTC, including) taking action when payment processing companies that offer small business owners access to the credit and debit card system allegedly use illegal tactics to pitch their services.”

Common Deceptive Practices

Here are some typical deceptive practices to watch for:

-

Hidden Fees

Hidden fees are the most common issue that businesses run into. These fees may include charges for signing up for a service, set up fees, and ongoing service fees that might be charged monthly. Hidden fees can significantly impact your costs.

-

Low Introductory Rates

It’s not uncommon for vendors to lure new customers in with a “teaser” or low introductory rate that increases over time. Depending on how you will process transactions, equipment leasing costs could add to your credit card processing expenses. -

Long-term Contracts

In some cases, long-term contracts may apply that come with high cancellation fees, making it difficult for you to switch to another vendor.

Questions to Ask Potential Processors:

- What payment methods do you support?

- What is your pricing model?

- What is your fee structure?

- Do you have setup or other fees we should be aware of?

- Is your solution PCI compliant?

- Can you provide a detailed breakdown of what my monthly statement will look like?

- What level of security do you offer to protect business and customer information?

- How long will it take for funds to clear in our business account?

- Will your solution integrate with my existing sales and accounting platforms?

- Do you have any minimum processing requirements or monthly transaction volumes?

- What ongoing customer support do you offer? Are there additional fees for this support?

Evaluating Reputation and Trustworthiness

In addition to asking questions about the processors you’re considering, do your due diligence by reviewing vendors’ websites, searching for other information online, and asking for and contacting other customers.

Take your time when evaluating options. This is an important decision that can carry significant costs for you—and your customers—as well as the potential for service and security breakdowns.

Successfully Transitioning Your Business Payments

Transparency is required in the credit card processing relationship. In some cases, almost intentionally, other credit card processors will make it very confusing. Confusion often leads to inaction.

Your selected credit card processing partner should work with you to help find the most appropriate solution for your needs based on your average transaction size and total amounts processed. You should have the right solution for your situation at the right price point. Education should be part of the communication process both before and after you make a selection. You should expect to fully understand why you need the recommended solution, how it will benefit you and your customers, and what it will cost--with no hidden fees or surprises later.

Sometimes, your best option will be the one they’re currently using. There's no compelling reason to make a change when there isn’t a lot of time or money savings compared to your current credit card processing solution.

We’re small business owners ourselves. We get it. But when the time is right, here’s how we can help.

Planning the Transition Timeline

There are a number of steps involved in the credit card processing transition, including:

- Identifying your unique business requirements.

- Checking for compatibility with existing systems.

- Coordinating timelines with your internal teams.

- Planning for training.

- Planning for testing.

- Identifying any potential for downtime during the transition.

- Notifying customers and other partners as necessary.

- Monitoring the transition and making adjustments to ensure everything flows smoothly.

Addressing Changes With Staff

Another pain point you should prepare to address when changing processes is pushback from employees. Resistance to change is to be expected, but there are ways to proactively prepare to address concerns and convince employees that the change is to their benefit. You need sophisticated technology that is continually updated with your needs in mind. You don’t need complexity, constant change, and confusion. As the Motley Fool points out:

“For a company to grow it must embrace change...change management is one of the most challenging business concepts to grasp.”

Communicating With Customers

If your customer will be affected, it is also important to communicate with them on a change in process. Ideally, your customers shouldn’t need special communications—the process should be entirely seamless for them in most cases. The greatest impact may be obtaining card numbers again to process payments in your new system. But taking the time to communicate change to avoid surprises matters to consumers and is worth the effort.

Training Staff on a New System and Process

Your credit card processing partner should provide training for your team during implementation. You’ll also want to ensure ongoing training and information resources are available during implementation and moving forward.

Look for a processor that can meet all your needs—and grow with you as you continue to build the volume and levels of your payment processing needs.

Conclusion

A critical milestone for successful businesses is when they outgrow their basic credit card processing solution or when they first recognize they need a solution to meet customer or client demand. When you reach this milestone, look for a processor that meets all of the requirements we’ve covered here.